Developed in partnership with The Wall Street Journal, WP&C’s Global Markets Complexity Index (GMCI) seeks to help decision-makers assess geographic expansion by introducing a new framework rooted in an analysis of market, operational, and regulatory complexity across 83 countries. These three categories—detailed in the GMCI report—represent the most important dimensions of complexity businesses encounter when expanding to new countries.

Few decisions are more significant for a business than the decision to expand overseas. Executed well, such a move is a means to achieve scale by providing companies with access to new markets, customers, and revenue streams. Done poorly, it can lead to a world of headaches and even threaten the core business.

Unfortunately, for many companies, the process for identifying target markets is ad hoc and unstructured, more anecdotal than rigorous, and lacks a consideration of the additional complexities associated with operating in a new market—and there can be many. It’s not unusual for a company to underestimate the difficulty of marketing to a new consumer base, to struggle to navigate a complex regulatory environment, or to see costs skyrocket due to unanticipated operational challenges.

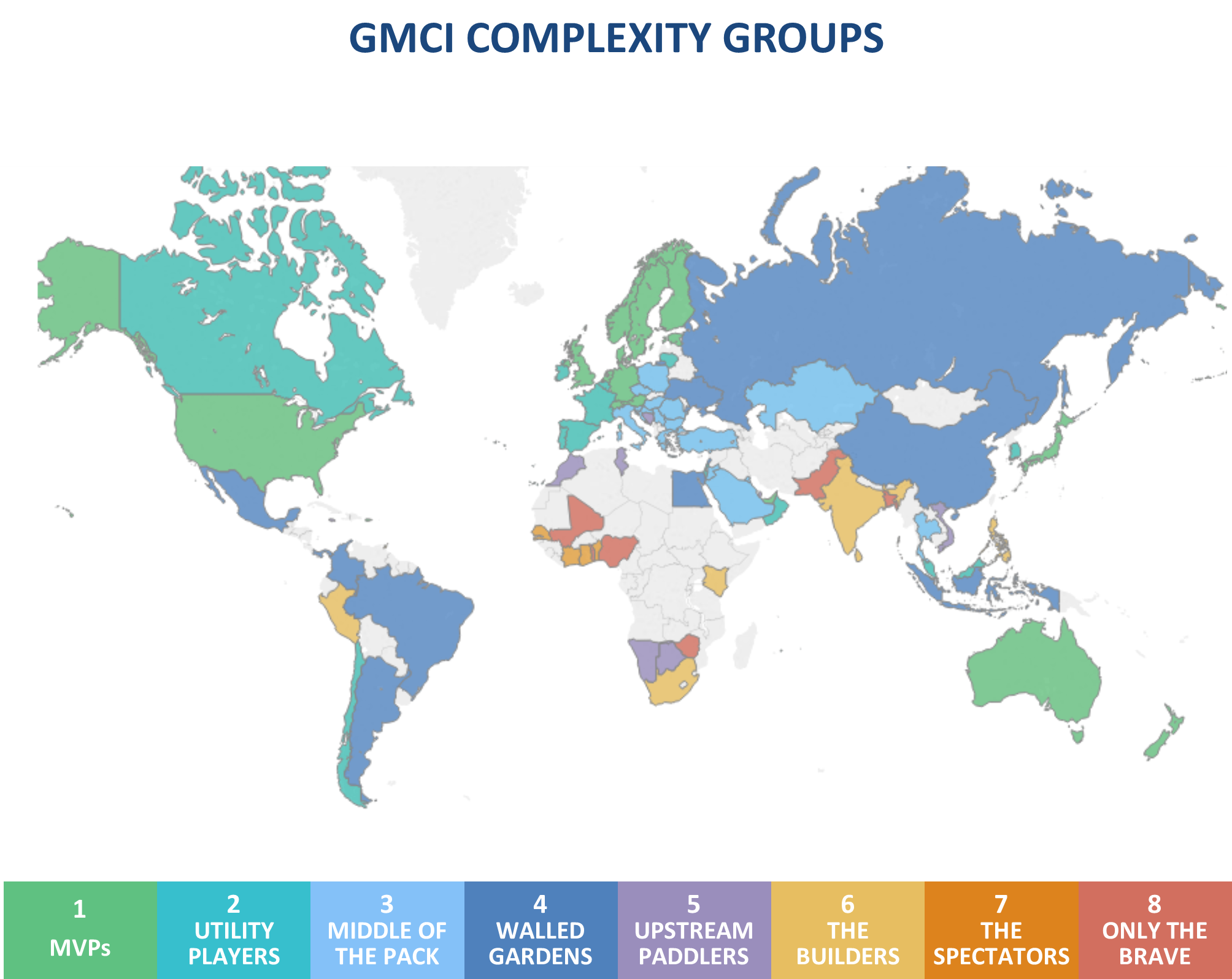

Based on our analyses, we developed country profiles based on different aspects of complexity—for example, high market complexity + low operational complexity + low regulatory complexity—and classified countries into eight distinct groupings using machine learning. These groups of countries with similar complexity profiles are the crux of the GMCI. Past success in one country suggests an opportunity to leverage complexity management capabilities in another country in the same group.

At each end of the spectrum you’ll find the usual suspects. Group 1 (MVPs) is comprised of countries with very low complexity—including U.S., U.K., Australia, Germany, Japan, and the Nordics. Group 8 (Only the Brave) is at the other end of the spectrum and includes countries with high complexity in every category. This group includes Nigeria and Pakistan—both represent large market opportunities for the right business with the right approach, but are challenging for the uninitiated.

Perhaps the more interesting groups are those that sit between the extremes. These groups—such as Group 3 (Middle of the Pack), Group 5 (Upstream Paddlers), and Group 6 (The Builders)—all have specific complexity challenges. But if the complexity is understood and mitigated as part of the growth plan, there is also ample opportunity.

If you’re operating in one of these countries already, you may be interested in discovering analogs. One of the primary use-cases for the GMCI is exactly that—think of it like a Netflix recommendation. If you’re already successfully operating in a Group 5 country, such as Morocco, then you may do well in Tunisia or Vietnam, other Group 5 countries with high operational complexity.

On the flipside of expansion, we have contraction. Many companies today find themselves overextended, with operations in unprofitable markets and resources strained by complexity challenges. The GMCI provides a framework for identifying countries that do not align with a company’s strengths and create too many unique management needs. These outliers, frequently ‘the problem children,’ should be candidates for exit.

You can access our interactive dashboard and download our full report at www.wilsonperumal.com/GMCI.

We welcome your feedback and questions at contact@wilsonperumal.com.