The business represented thousands of clients in retailers nationwide, but lacked standardized offerings, pricing, contracts, or service levels. This resulted in extreme complexity and made knowing where their revenue and costs were coming from impossible to track, much less manage. The business needed WP&C's help to untangle complexity and provide a clear picture of client profitability.

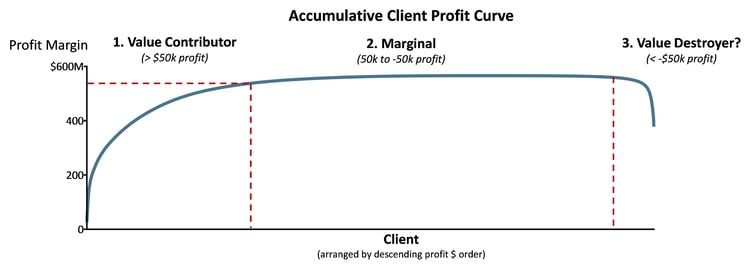

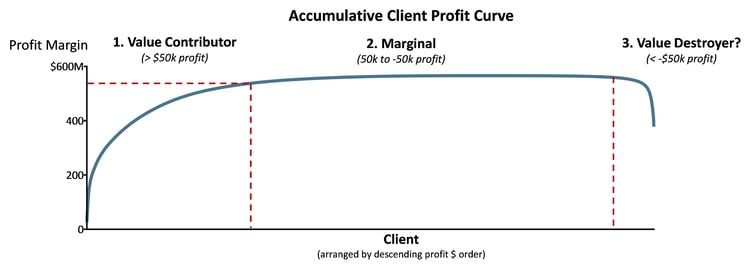

But understanding client profitability wouldn’t be enough. The business’s client relationships could be intertwined; serving one unprofitable client might be necessary to serve a profitable one. And high fixed costs spread fractionally across thousands of smaller clients made blanket measures like cutting all unprofitable clients or reducing service inadequate. To improve EBIDTA, each client would have to be addressed individually.

1. Build client profitability model

WP&C conducted a cost deep dive, gathering internal financial data and breaking down costs by segment, customers, regions, and other key dimensions. We then constructed a model to determine the profitability of each client over the previous year. We applied our Square Root Costing methodology to quantify the impact of complexity at the business unit, service, and client level. And we designed the model to be dynamic, capable of being updated on a regular basis to provide the business with a consistently up-to-date view of their client relationships.

2. Identify client profitability opportunities

Using the Client Profitability Model, WP&C showed the business, for the first time, how much value each client was creating—or destroying. We selected clients for profitability improvement workshops—meetings with client managers and business unit leaders to create client-specific profitability improvement plans—by assessing the largest EBITDA opportunities, as well as qualitative input such as recent history and strategic fit.

3. Conduct client deep dives and implement profitability improvements

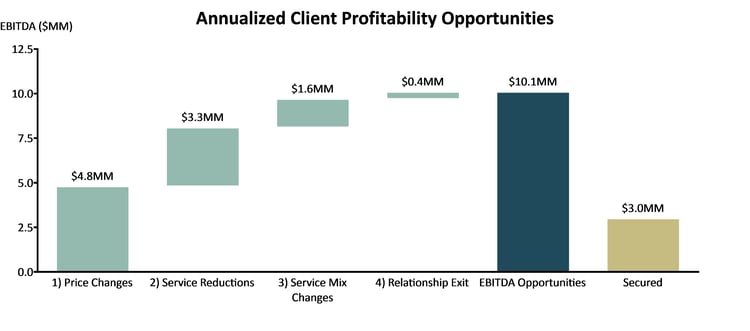

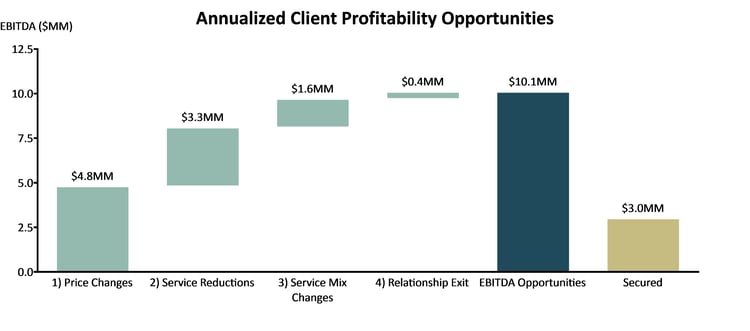

Finally, WP&C created the workshop process and tools to guide the Finance, Strategy, and Sales leaders through deep dives into their most urgent and important-to-address clients. We derived and documented profitability improvement strategies for each one, along four levers: (1) price changes, (2) service reductions, (3) service mix changes, and (4) relationship exits. We then worked with the client leads to implement these profitability improvements and track their impact. Finally, we created a detailed playbook outlining the workshop process—from client selection to impact tracking—and associated tools for managing outcomes, allowing them to recreate the process as needed.

Backed by the Client Profitability Model, WP&C designed a comprehensive plan for business units and client managers to own and continuously improve client profitability:

- Focusing on the largest opportunities in EBITDA dollars to select clients for deep dive workshops and prioritize based on performance, strategic fit, and likelihood of opportunity

- Conducting workshops to discuss context of client relationship and growth strategy, and analyze historical data to establish profitability improvement levers including: (1) price changes, (2) service reductions, (3) service mix changes, (4) relationship exits

- Quantifying the value, probability, and timing of each profitability lever and developing a plan to achieve profitability targets

- Implementing profitability improvement actions throughout the year, while keeping client specific action plans up-to-date to track progress and realized opportunities

WP&C created a dynamic Client Profitability Model and began pinpointing and implementing profitability improvements for several of the business’s largest clients, a process for which we left behind a playbook for the client to leverage to continue to address client profitability.

Within two months of the engagement, the client had identified $10 million in EBITDA improvements, and had captured a $3 million EBITDA run rate.