What are Complexity Costs?

An ice cream company decides to add low-fat flavors to its existing product offering. Doing so requires additional ingredients to be stocked, increased changeovers at the plant, additional raw and finished goods inventory and higher distribution capacity – these are all complexity costs. They are the non-value-added costs associated with offering a larger number of products. For instance, adding a member to the procurement team to manage the additional ingredients is a cost that results from the increase in product complexity.

Why are Complexity Costs important?

Why are Complexity Costs important?

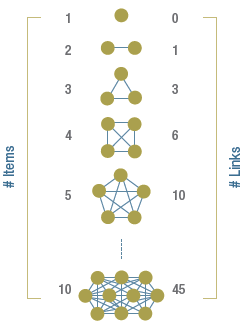

In our experience, complexity costs are the biggest determinant of a company’s cost competitiveness. They are especially important because most companies are ill-equipped to measure and manage them. They do not function like fixed or variable costs, as they are geometric in nature and do not simply scale with the number of units sold. Complexity costs do not rise in proportion to the number of items in a company’s portfolio; they rise in proportion to the number of links between items as they interact with each other (see Figure 1). In fact, while many costs depend only on individual items (for instance, raw materials and production labor costs), the complexity costs of an incremental product are highly dependent on the costs of the items that came before it.

Complexity costs can be especially insidious because they traditionally have been very difficult to measure. They are not associated directly with a product, but rather driven by the interface between products. Therefore complexity costs are often allocated to “adjustment” buckets or allocated improperly across products. Additionally, complexity costs tend to be step functions as a single new product may create the need for costs such as new corporate positions, new production equipment or overflow warehouse space. Also, beyond the hard financial costs, complexity can drive significant opportunity costs. This is why cutting complexity also allows companies to grow. Sales force time focused on incremental products, slower IT system response times and changeover times and costs are all examples of opportunity costs driven by complexity that can impede growth.

The WP&C approach to Complexity Costs

WP&C is the leader in helping companies identify, measure and remove complexity costs – our book, Waging War on Complexity Costs, is the leading business book on the subject. We recognize that while complexity costs creep in over time, they need to be removed in chunks to realize maximum benefit. We approach complexity costs by first understanding the areas of opportunity across product, organizational and process complexity. This allows us to identify the “size of the prize” and build the business case for attacking complexity costs. We also leverage Square Root Costing (see Square Root Costing Spotlight), a WP&C innovation, to accurately allocate complexity costs and identify the true profitability of product lines, business units, etc. Typically we find that after adjusting for complexity costs, the financial picture of an organization can be tremendously different from previous views. In this sense, understanding and adjusting for complexity costs is the first step in reassessing corporate strategy, maximizing profitability and improving shareholder value.