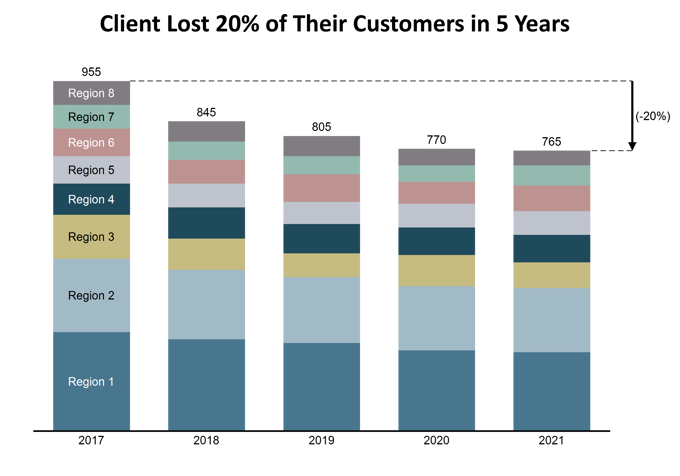

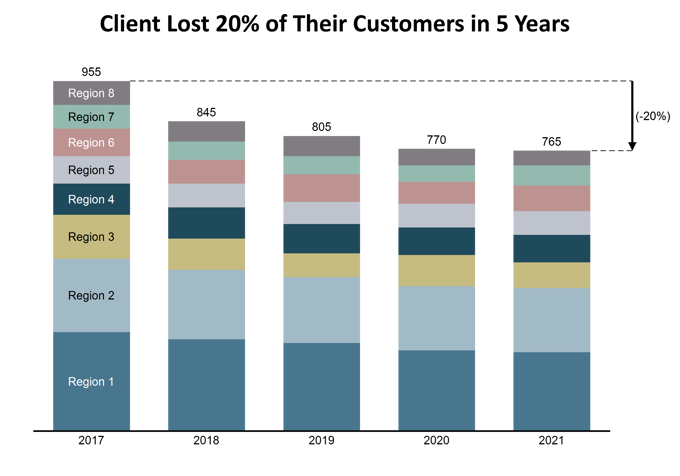

Coming out of the previous market downturn with significant fundamental changes since the last upturn (COVID-19, geo-political changes, growth in renewable energy and EVs, etc.) there was new uncertainty on where and how to focus the business. In the past five years the company had also brought new products to market with varying levels of acceptance. With all this, several peer competitors were gaining share and improving customer perceptions (through marketing, product specs, coverage). Our client had lost nearly 20% of their customers in the last 5 years.

On a region-by-region basis, the company needed to rethink market attractiveness, its ability to win, customer channel focus, offerings (products, terms, service levels, etc.) and investments in working capital, long-term capital, and sales & marketing resources.

WP&C’s approach included obtaining both internal and external perspectives to understand where to play, how to win, and what investments may be needed.

WP&C provided regionally-tailored go-to-market strategies identifying which regions should be avoided, which regions must be actively defended, and which regions should be pursued for growth, along with specific actions (from marketing to inventory investment) to win in each region. Additionally, our team provided recommendations on product offerings and pricing in order to better compete in the market.

These product and go-to-market strategies were supported by an overhauled manufacturing and supply chain strategy. By utilizing a variety of levers including outsourcing, optimized inventory levels, automation, supplier changes, etc., our team and the client were able to identify significant cost reduction and delivery improvement opportunities.

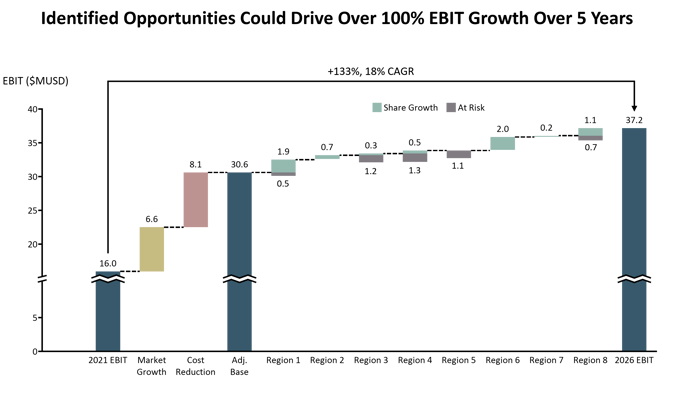

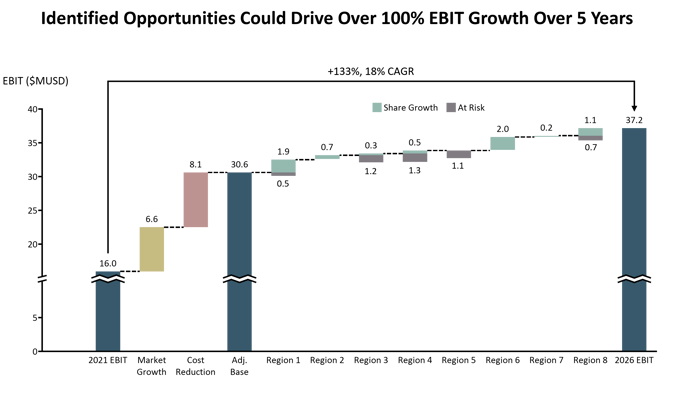

Evaluating internal and external perspectives to develop complementary go-to-market, product, and manufacturing strategies, WP&C was able to identify opportunities to grow revenues by $32M or more than 50% (including market growth).

Paired with cost reductions, this revenue growth enables EBIT to grow by $21M or more than 100%, equating to an 18% EBIT CAGR over five years.