Shortly after acquisition three years before, the fabricator saw significant turnover from senior management as well as the departure of half the sales force. Over time, a new talented management team rebuilt the sales force and repaired strained customer relationships.

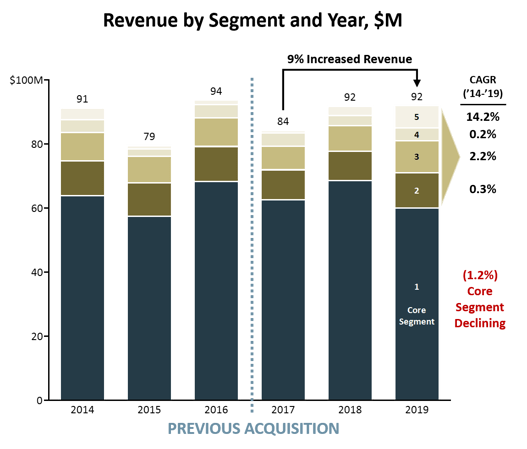

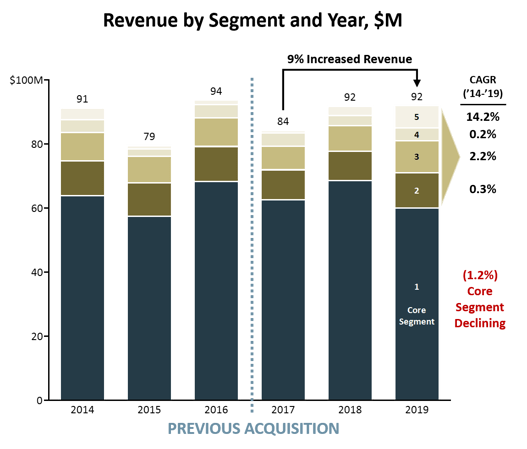

Although revenues were growing overall, the fabricator’s share of its core segment was declining and the sales team was struggling to capture more share in its home market. The highest margin products proved to be a distraction, as they were also the smallest growth segments with the most uncertainty.

The acquiring PE firm needed an objective 3rd party to perform a market landscape assessment to test their investment thesis and growth strategy.

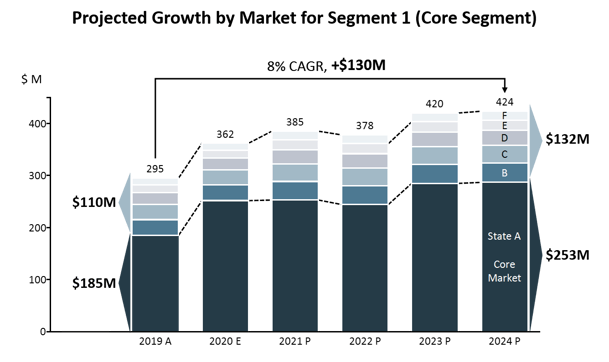

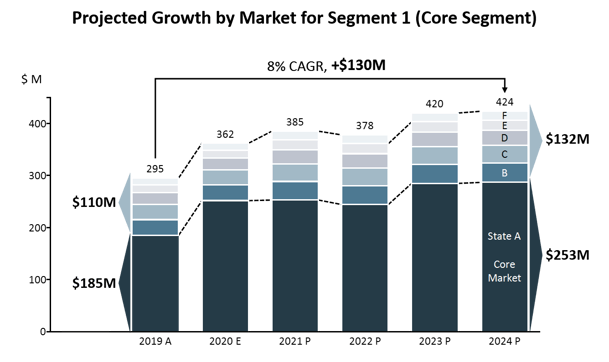

WP&C first analyzed historical revenue by product segment. Since the regional market included several collar states, each with its own economic environment, the product lines were further segmented by each state as well. Next, WP&C used industry research and expert interviews to define the primary levers that would be stimulating or inhibiting each segment in a given state in the coming years. This included changes to regulations, demographics, technology, economics, taxes, tariffs, and adjacent complementary industries.

Exogenous shocks like shifting political winds, the global pandemic, and enviro-economic policy modified the growth projections. Finally, WP&C explored extending the client’s expertise outside of the core region by developing relationships with current key partners that could seamlessly integrate the client’s products in previously inaccessible states.

Most importantly, WP&C identified a previously unrecognized revenue opportunity of ~$130M in the core segment.

WPC recommended divestment from a low-growth product segment that created organizational complexity through low volumes and high customization. The remaining segments were classified by the total market size, their growth attractiveness, and their relative ability to compete. We accompanied each segment assessment with recommended actions. The action plan for the smaller product segments required engaging current channel partners to coordinate a new go-to-market strategy to capture the growth opportunities.

The primary segment in the core market presented an irresistible opportunity. Both the PE firm and the Fabricator were previously unaware of ~$130M growth in the core market. We helped the client craft a plan to retrench and surge resources back to the primary segment to own the home market.

Using WPC’s detailed and objective third-party due diligence of the Fabricator’s growth potential, the acquiring PE firm successfully raised the remaining capital to finalize the deal. WPC’s identification of the previously unrecognized opportunity in the core market tipped the scales for the attractiveness of the deal.

Based on the projected market growth and pro forma income statement, the PE firm was planning a debt paydown over 5 years, for an IRR of 26%, and a 6x exit multiple. With a growth strategy properly aligned with the market, the new management team could focus on executing their business transformation plan and boost margins.