Prior management’s focus on top-line growth had caused its finance, accounting, and tax operations to expand to satisfy requirements from new acquisitions, service offerings, and bespoke client requirements. This short-term focus and a fragmented governance structure allowed non-standard processes & roles to proliferate.

Management struggled to have a clear view on how its processes delivered services, which contributed to a poor ERP implementation. The poor technology implementation further hampered the finance department’s ability to provide efficient and effective service.

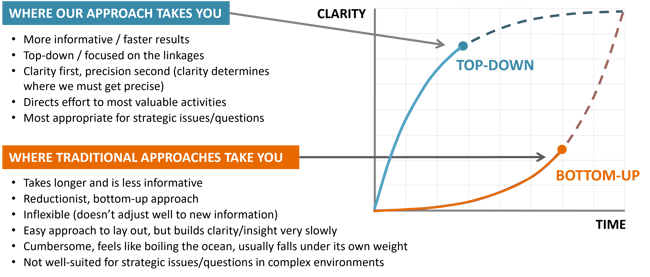

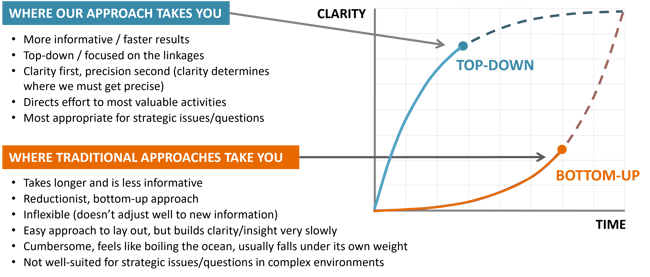

WP&C’s hypothesis-driven approach enabled our team to conduct a quick, targeted assessment of people, process, and technology within the finance, accounting, and tax operations. The assessment identified the sources of complexity and informed quick-win cost improvements and a path forward to reduce and maintain costs by:

- Developing a baseline by inventorying activities & roles through targeted SME interviews and time studies to identify focus areas that consume time & resources

- Conducting deep-dive analysis on time-intensive, difficult, and error-prone processes to assess:

- How time consuming is the process?

- What are the drivers of process variation and performance?

- How much of the process is done manually?

- What is the risk in not doing the process right?

- Leveraging our subject matter experts that had led multiple, large re-structuring and offshoring transformations

- Developing fit-for-purpose recommendations that reflected each process’s attributes and whether offshoring, ERP enhancements, process automation, and/or process standardization is appropriate

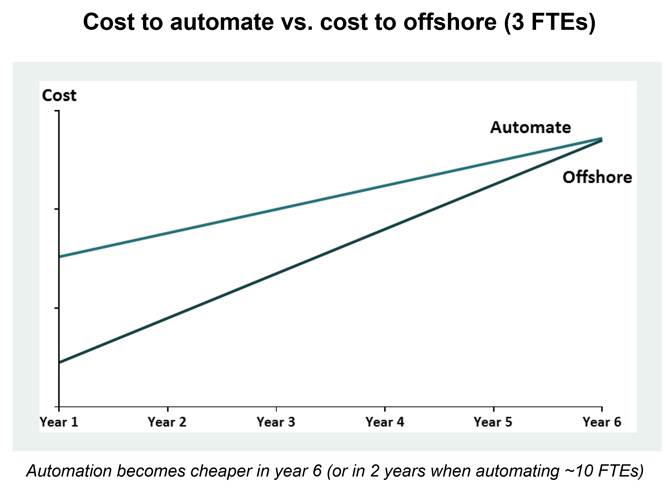

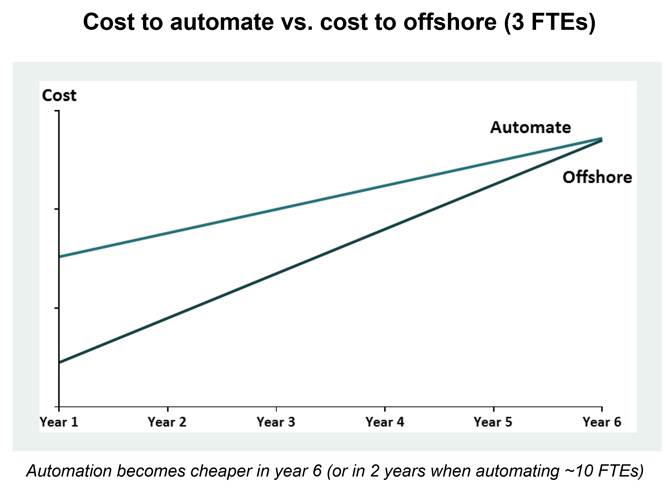

WP&C determined that offshoring and restructuring would enable the organization to realize value faster and provide flexibility & predictability going forward versus large-scale process automation. To capture the value, the WP&C team developed a transition plan and partnered with the team to re-design processes, roles, and the organizational structure by developing future state enablers, including:

- Procedures: Through workshops and interviews with leadership and frontline service delivery, WP&C identified best practices throughout the organization, re-designed & standardized processes, developed training content and work instructions for on-shore and off-shore personnel to document the future state procedures and ensure a smooth future state transition.

- Org Redesign: By leveraging extensive organization re-design experience and external experts, roles were re-designed to reflect future state on-shore and off-shore processes. This reassignment of roles shifted the Finance organization from a generalist to specialist model. The overall Finance organization was re-structured to be more efficient, effective, and scalable.

- Technology: WP&C partnered with the client to develop and deploy workflow solutions to better utilize technology/tools and enable future state processes.

- Metrics: Governance model was developed in close partnership with Finance leadership to enable the successful transition and change management, including a new set of leading & lagging metrics to monitor the performance of the future state processes.

- Change & Communication Plan: Stakeholder impact analyses were conducted to evaluate the level of impact and guide and inform the transition plan. The analysis and plans were essential in limiting unplanned attrition and enabling a successful transformation.

The structured approach allowed the client to exceed the original benefit case and realize a reduction in run-rate expenditures by 33% within 9 months. In doing so, the client’s G&A expenses achieved parity with peers. These results were achieved through close collaboration that enabled the organization to transform its finance, accounting, and tax functions and implement measurements to monitor the performance of the future state process.