The company, having come together as a merger of equals, still operated with a locally-owned, locally-operated mindset. This meant they were effectively running over 300 small businesses while also overseeing franchise operations. New shared services had been quickly established for Finance and I/T while a national-level operations support team provided overflow capacity and special services to branches. While this structure made sense on paper, execution proved challenging given the number of interactions between branches and corporate, the ambiguity that remained in terms of ‘who owned what’, and an ineffective one-size-fits-all approach for deploying change.

With recognized experience helping companies unwind complexity, the WP&C team started at corporate, moved into branch operations, and later returned to corporate to ensure sustainable results. Over the course of work, the team:

- Dove into Accounts Receivable and Collections to quickly and accurately understand the drivers of stubbornly high receivables

- Moved into the branch-level, conducting over 60 site visits across the country to identify and categorize local challenges, leading practices, and technology fit

- Conducted multiple workshops with combined branch and corporate teams to clarify where and how support was and was not working well

- Identified over one hundred needed improvements and worked with the executive team to prioritize five for rapid testing and deployment

- Returned back to corporate to incorporate lessons-learned, taking initial improvements there another step further

Throughout the project, WP&C worked with the management team to continuously develop, prioritize, and implement improvements across the business to:

- Shift the modus operandi in Accounts Receivable and Collections from reactive to proactive and shift the organizing principle from singularly global to a mix of global and regional

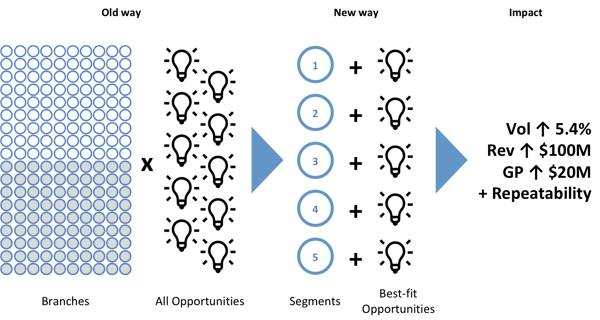

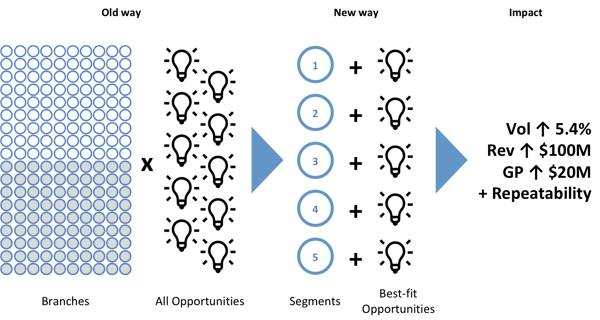

- Segment branches on more than size and location—including factors which make them similar, such as customer mix, population density, unemployment rate, and staff size

- Prioritize, target, and deploy operational and technological improvements based on a branch’s new segment and move away from a one-size-fits-all approach that failed to recognize fundamental differences

- Tailor and implement improvements side-by-side with branch personnel ensuring adaption with solutions that are practical and aligned with operating norms

- Undertake fewer corporate-driven improvements (including technology upgrades) and codify a more dynamic tool-set for deploying future change

WP&C’s unparalleled understanding of how to identify and untangle complexity in organizations helped this client see their business in a different light and guided them to better execution, not only day-to-day business but also corporate change initiatives. WP&C worked openly and collaboratively with corporate and local teams to build the trust and credibility needed to get change done and to make it stick. With COO and CFO sponsorship, the team successfully met and exceeded original expectations by:

- Realizing a $120M uplift in revenue and a $20M improvement in gross margin

- Improving fill-rate by over 500 basis points in a very tight labor market

- Reducing working capital by $30M and halving unapplied cash