The Company grew or acquired over 25 brands and more than 2,500 products. Its Commercial and Finance teams could no longer keep up—all their time was spent putting out fires and reporting little leftover capacity for optimizing the portfolio, planning strategic promotions, or choosing optimal new products. In the meantime, customers were asking more and more financially and operationally.

Having tackled similar issues before, the WP&C developed and executed a five-week assessment and pilot focused on one mainstay category, followed by a 16-week implementation phase that built learnings and optimized profitability across all remaining categories. This work included:

- Applying WP&C’s unique Square Root Costing methodology to quickly and accurately identify where profitability is actually realized at a product and customer level

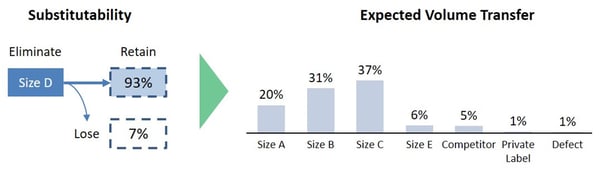

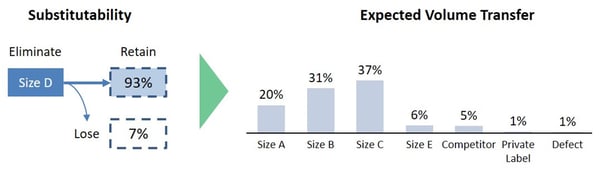

- Developing a statistically-based, validated approach for determining product substitutability and defect rate in order to help rationalize like products

- Developing a product management playbook to codify and layout out a new approach for assessing category performance and guide ongoing decision-making for pricing, promotions, new product introductions, SKU rationalization, and design-to-value opportunities

- Understanding and aligning customer strategies and company-value propositions to help build the plans and stories necessary to manage customer relationships through the transformation

- Working at both brand and product levels to ensure coherence and the right category ranges and depths to remain viable with room for growth

Throughout the project, WP&C worked hand-in-hand with Finance, Commercial, and Supply Chain teams to identify, qualify, and implement critical recommendations to:

- Divest fast-declining owned-brands, freeing up working capital and commercial capacity

- Exit a non-core, underperforming, high cost-to-serve category altogether, reducing costs-to-serve

- Remove five low-performing brands, reducing trade spend dilution and improving overall growth trajectory

- Rationalize underperforming and inactive SKUs in all remaining categories (~30% of total), realizing improved portfolio coherence and promotional effectiveness

WP&C brought a new way to see profitability at a product and customer level and thus a new way of seeing and running the overall business. Overcoming passive-aggressive resistance to change in the Commercial area through fact-finding, collaboration, and piloting, WP&C helped this company get back on track by aligning its value proposition and portfolio with its customers and freeing up resources for investment in new, higher-growth opportunities. By the end of the project, WP&C was supporting client teams and plans to realize:

- 7% uplift in EBIT

- 18% reduction in working capital

- €2M+ divestiture opportunity

- 15% fewer brands and ~30% fewer SKUs